FACTORS INFLUENCING AGRICULTURAL CREDIT UTILIZATION: A BORROWERS' PERSPECTIVE IN TALUKA HYDERABAD RURAL SINDH, PAKISTAN.

Keywords:

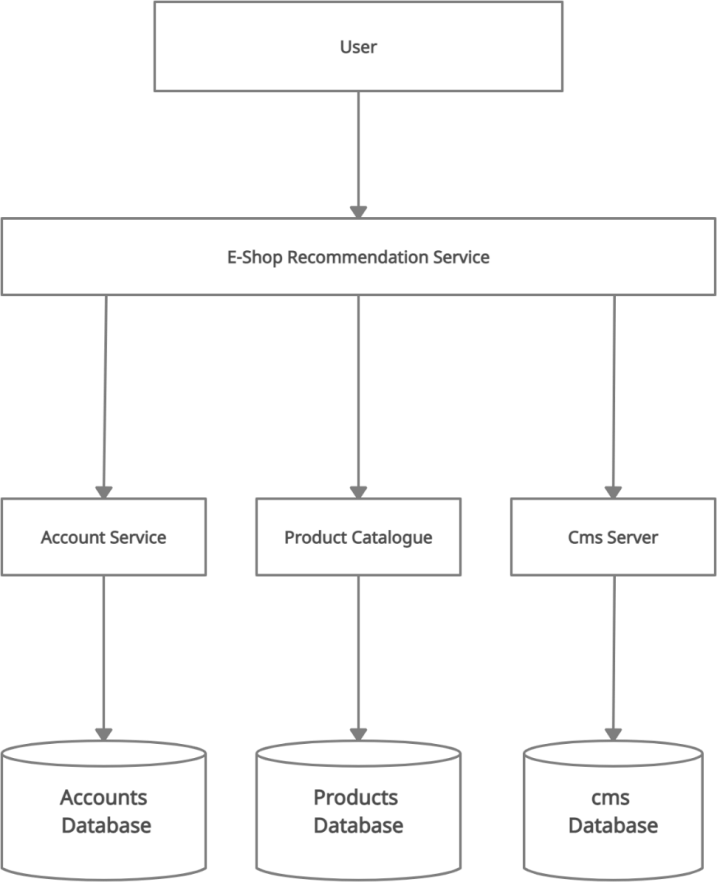

e-commerce, recommendation system, web services, inventory systems, point-of-saleAbstract

Agriculture credit is required for the development of agricultural activities. Commercial and government banks play a vital role for the agricultural credit to the former. This data was collected from banks in the vicinity of the taluka Hyderabad rural Sindh and personal interviews were taken from the credit borrowers (formers). The current study attempted to comprehend the variables impacting the use of bank credit. The samples of 100 former respondents were chosen for the present study. All data are tabulated, summarized and analyzed through SPSS (Social Science Statistical Software Package) computer software. Furthermore, the fact clearly shows that the literacy rate of the farmers interviewed is 88%, which is encouraging considering the farming domains' elevated literacy rate. The response to this effect is reported in Table 1, indicating that the majority of farmers (87%) respondents use loans for agricultural activities and respondents (13 %) use loans for non-agricultural activities. Hence there is an impact of institutional credit on positive relationships with agricultural borrowers. The research revealed that the use of agricultural credit in rural Sindh's Taluka Hyderabad is influenced by factors related to agriculture, demography, and agricultural credit.

Downloads